-40%

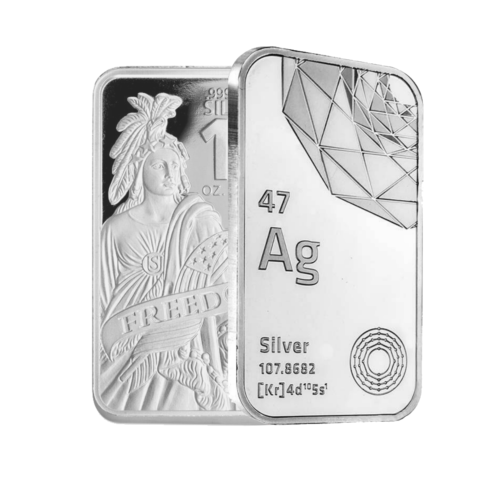

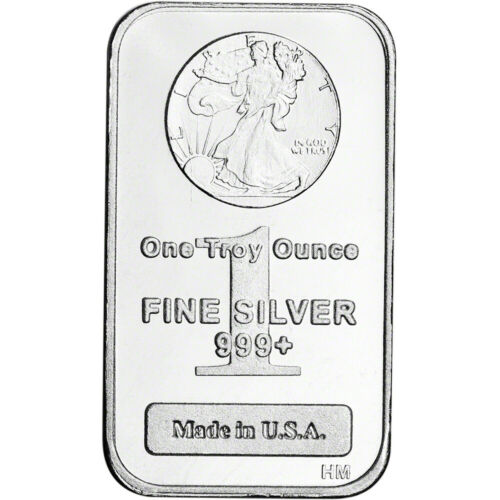

BACHE 1 OZ Vintage Silver Bar #6

$ 15.1

- Description

- Size Guide

Description

This 1 Troy oz .999 fine silver bar was minted for the storied Bache and Company securities firm.I bought a number of these quite a few years ago from a woman that told me her deceased husband bought them brand new, she thought, in 1981. Still mostly shinny shiny due to very little handling but use the photos to judge for yourself. I did put this in a new pouch as the originals are just too brittle and splitting to due to age. Otherwise this is how I got it.

The LAST photo is what these beauties look like with a little bit of silver polish.

>>>I'm selling these to pay for medical expenses, so please NO RETURNS unless you don't receive what is listed. Items removed from the shipping card WILL NOT BE ACCEPTED under any circumstances.<<<

Being sold for their silver content and no other value is implied.

What you see is what you get, exact item as pictured.

Opening bid will be around the current spot price plus 10% > .60

Combined shipping at the rate of .00 per each additional item, when all items are paid at one time.

Bache and Company were looking for a White Knight in 1979 to fend off a takeover attempt by the Belzberg family, and ended up in business with Bunker and Herbert Hunt. As we all know, the Hunts attempted to corner the silver market, which they ran up to more than an ounce, from less than . Unfortunately Bache extended a quarter of a billion dollars of margin to the Hunts without establishing whether they could produce the cash if need be.

On Jan. 20, 1980, the Commodity Exchange torpedoed the Hunts by forbidding new orders in silver futures except to liquidate existing positions. On Thursday, March 27th 1980 (Silver Thursday) Bache issued a 0 million margin call to the Hunts, which they could not meet. As the price of silver slid to , Bache had to dump some of their silver, depressing prices further. Outside speculators began dumping too. In fact a general panic in the commodities and futures markets ensued.

A consortium of US banks provided a .1 billion line of credit to the brothers which allowed them to pay Bache which, in turn, survived the ordeal. However, the beleaguered Hunts sold their Bache stock to the Belzbergs, whose holdings thus reached 14 percent.

In desperation, Bache sold out to Prudential (do you remember Prudential-Bache, don't you?), consoling the Belzbergs with a million profit.

These bars have all that history behind them, one of the greatest stories in the history of commodities trading.